2023-11-27

· Net profit of THB 2,099 million and EBITDA of THB 7,460 million, an increase of 289% compared to the same period last year, underscoring the synergistic value of the Temple I and Temple II gas-fired power plants in the United States

· Invested in SVOLT Thailand through Banpu NEXT, boosting its presence in the energy technology sector and facilitating the expansion of the electric vehicle industry in Thailand

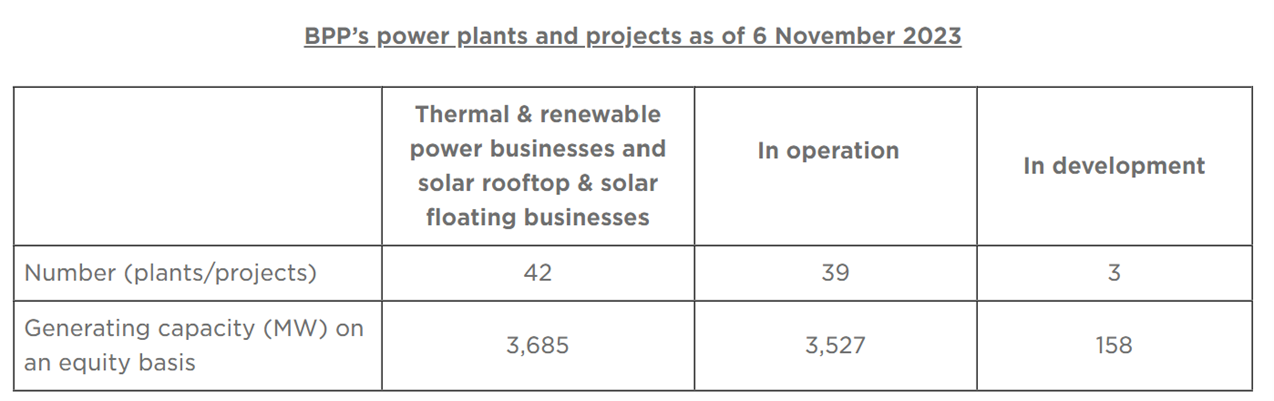

· Committed power generation capacity of 3,685 MW, aligning with BPP’s strategy to broaden its business ecosystem and achieve sustainable growth across eight strategic countries

Banpu Power Public Company Limited (BPP), an international quality power generating company committed to providing sustainable energy under the “Powering Energy Sustainability with Quality Megawatts” concept, recently unveiled its operating results for the third quarter of 2023. BPP achieved a net profit of THB 2,099 million, and earnings before interest, tax, depreciation, and amortization (EBITDA) of THB 7,460 million, representing a robust increase of 289% compared to the same quarter in the previous year. Throughout the third quarter, BPP effectively maintained the reliability of electricity generation and distribution across all its power plants and implemented stringent risk management strategies to mitigate fluctuations in electricity prices. BPP is well-prepared to expedite the development of a well-balanced portfolio encompassing both its thermal power and renewable power businesses. As a result, BPP continues to achieve robust cash flow and profit margins, pursuing its goal of achieving production capacity of 5,300 MW by 2025 in accordance with its Greener & Smarter strategy.

In reference to the operating results in the third quarter of 2023, the standout contributors were Temple I and Temple II, the two gas-fired power plants in the United States. Temple I, in which the Company invested at the end of 2021, and Temple II, acquired in mid-2023, jointly recorded total revenue of THB 15,008 million, marking a substantial increase of 289% compared to the same period in the previous year. Both gas-fired power plants achieved an exceptional Equivalent Availability Factor (EAF) of 99%, solidifying their status as reliable and efficient power assets in the Electric Reliability Council of Texas (ERCOT) market being able to meet the heightened electricity demand particularly during the scorching summer months when Texas faced a heat wave crisis. This factor enabled cash flow and profit generation during periods of extreme heat and rising electricity prices, aligning with the dynamics of the market.

Mr. Kirana Limpaphayom, Chief Executive Officer of Banpu Power Public Company Limited, said, “The exceptional performance of the Temple I and Temple II gas-fired power plants in the US underscores our successful investments and operations in the twin power plants located in the promising market. This achievement is attributed to several favorable factors, such as the high demand for electricity during the summer season, which is the peak period of electricity consumption. Additionally, we have implemented risk management strategies to maintain a steady cash flow, utilizing a range of financial instruments, including price insurance for these two power plants of 700 megawatts, accounting for approximately 50 percent of the total production capacity from the fourth quarter of 2023 to the fourth quarter of 2024. This proactive measure ensures income stability even outside of peak seasons, and encompasses a comprehensive response and maintenance plan, enabling us to be well-prepared and ensure an uninterrupted and efficient supply of power during the upcoming winter season.”

Furthermore, the BLCP power plant in Thailand operates with remarkable efficiency, boasting an Equivalent Availability Factor (EAF) of up to 99.9 percent. This impressive performance ensures a continuous supply of electricity production and distribution. Additionally, all three combined heat and power (CHP) plants, including the SLG power plant in China, experienced increased electricity sales due to surging demand during the summer season. Meanwhile, BPP’s renewable power business in the third quarter of 2023 maintained steady growth. In Vietnam, solar and wind power plants collectively saw an increase of 33% in total revenue compared to the same period last year, while the rooftop solar project in China’s Zhengding Province, supported by local government policies, has reached a production capacity of 66 MW. BPP is actively adding more megawatts to this project, with the potential of reaching 167 MW by 2023.

Through its 50% stake in Banpu NEXT, BPP has demonstrated a robust presence in the energy technology business, significantly expanding its rooftop and floating solar power capacities in Thailand and Indonesia this quarter. Furthermore, the Company has made strategic investments in integrated battery energy storage ventures, contributing to the advancement of the electric vehicle industry in Southeast Asia. To achieve this, Banpu NEXT has acquired a 40% ownership stake in SVOLT Energy Technology (Thailand) Co., Ltd., committing a THB 750 million investment. The battery manufacturing plant is located in Si Racha District of Chonburi Province with initial annual production capacity of 60,000 units, which will be delivered to customers in 2024.

“BPP, a leading power generating company, maintains a well-balanced portfolio of thermal and renewable power businesses. With operations spanning across eight strategic countries in the Asia-Pacific region, we remain steadfast in conducting our business in accordance with sustainability principles that prioritize environmental, social, and governance considerations, commonly known as ESG principle. Recently, BPP earned a recognition on the ‘SET ESG Ratings sustainable stocks’ list for 2023 at the AAA level from the Stock Exchange of Thailand (SET). This achievement emphasizes our unwavering commitment to investing in power plants that leverage efficient and environmentally friendly technologies, often referred to as High Efficiency, Low Emissions (HELE) technology. Additionally, we are committed to fostering innovation in clean energy, aligning with guidelines for carbon emission reductions and actively working towards decarbonization, together with an objective to generate sustainable returns and long-term value for our investors and stakeholders.” concluded Mr. Kirana.

Learn more about BPP’s businesses at www.banpupower.com